The Challenge

The United Nations Office on Drugs and Crime estimates that 2-5% of the global GDP is annually laundered, amounting to trillions of US dollars. Even though bank institutions spend billions fighting financial crime, law enforcement agencies reportedly confiscate less than 1% of illicit financial flows. As the digital environment, a crucial enabler of financial crime, is constantly evolving, so are the methods to conduct illegal financial activities. Hence, maintaining the initiative and keeping up with criminals is not a minor issue but an ever-growing challenge calling for solutions.

“Maintaining the initiative and keeping up with criminals is not a minor issue but an ever-growing challenge calling for solutions”

In December 2018, the US Federal Reserve and four other regulatory agencies issued a statement urging banks in the US to begin incorporating innovative approaches to anti-money laundering. The statement touches on the long challenge, i.e., to consider all available information and utilize the tools required to process and analyze it when combatting money laundering.

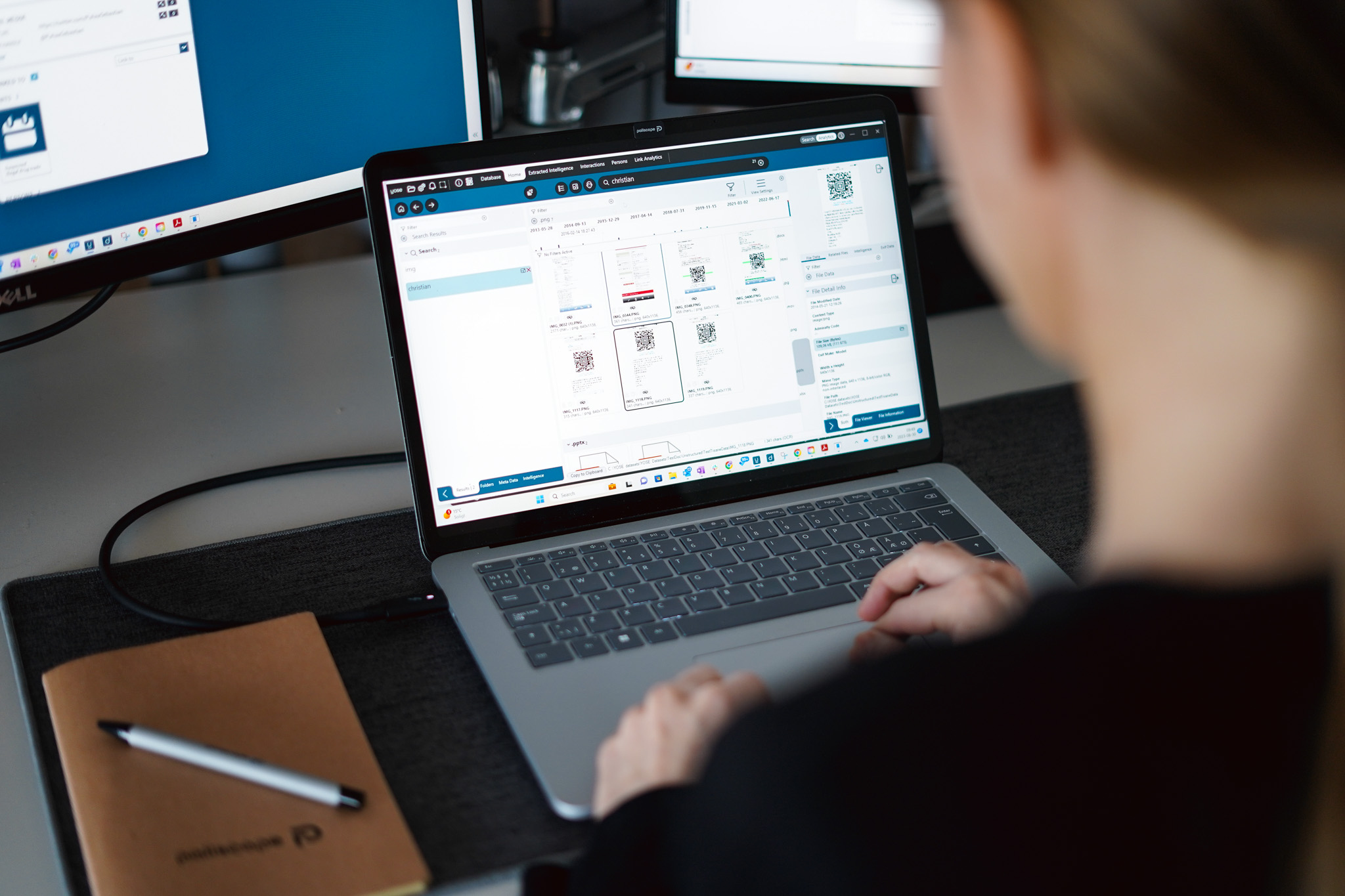

Investigators working on money laundering are contending with increasing complexity, especially as organized groups of criminals are responsible for a higher percentage of financial crime. Conducting investigations using advanced intelligence platforms, enabling network visualization, and processing vast amounts of data, including information beyond mere text, is a powerful way to tackle this complexity. The use of AI-integrated tools such as YOSE is a crucial add-on and force multiplier to more basic OSINT techniques and traditional methods as it allows analysts and investigators to embrace the opportunities and overcome the challenges associated with today’s information environment.

Key Benefits of OSINT combatting money laundering

When harnessed correctly utilizing efficient tools, OSINT offers several key benefits when conducting investigative operations targeting perpetrators of money laundering:

- It allows investigators to capitalize on the vast amount of data available on the internet rather than being limited by it.

- As financial criminals tend to change their strategies continuously, investigators need to follow. By deploying an agile approach to intelligence gathering, investigators can use OSINT for real-time monitoring by gathering real-time information on financial transactions, market trends, and online conversations. By doing so, investigators enhance their capability to identify suspicious patterns and emerging threats quickly.

- Automated tools for indexing and processing collected data enhance the prospects for transaction tracing, dark web monitoring, and corporate network mapping.

Even though money transfers may be highly complex, financial transactions are possible to monitor. OSINT allows investigators to follow paper trails and account movements by cross-referencing public records, financial websites, and internal organizations’ records. However, as such investigations’ complexity often makes the collected data elusive, automated processing solutions like YOSE offer a great advantage.

Moreover, solutions tailored for open source data analysis enable investigators to track money laundering schemes through the darknet by scanning data sources, underground marketplaces, and forums to gather actionable insights against malicious actors. Furthermore, it is possible to deanonymize hidden profiles by cross-referencing information from the Surface Web and darknet posts (even deleted ones) and conduct searches based on usernames and crypto wallet addresses, which creates opportunities to gain actionable insights. Once more, the enabler of such investigations when developing raw data into actionable insights and analysis products is the capability to grasp what is there and what is not. YOSE enhances such capabilities and creates structure in the chaos.

Finally, understanding how specific individuals are related to companies can become vital information for any investigator seeking to combat money laundering activities. OSINT allows investigators to visualize the organizational structure of companies by scanning corporate registries and thus deepen awareness of particular individuals or organizations of interest. By mapping a subject’s networks and creating a visual structure of collected and processed data, OSINT offers comprehensive insights for further analysis, which can reveal any suspected ties a subject may have, significantly reducing money laundering risk

“OSINT offers comprehensive insights for further analysis, which can reveal any suspected ties a subject may have, significantly reducing money laundering risks”

OSINT to counter systemic threats

Terrorist organizations and organized criminal organizations usually spread their financial operations across multiple countries, utilizing cryptocurrencies and blockchain technology, allowing them to exploit regulatory weaknesses in anti-money laundering systems. However, by collecting data from official sources such as financial records and registers, OSINT becomes highly valuable when investigating extremist groups’ assets. Gathered insights can play a pivotal role in dismantling terrorist and organized crime money laundering schemes. In addition, OSINT solutions can further enrich the data by conducting searches through social media and online forums, which can link suspects to known terror groups or extremist networks.

Even though blockchain technology offers a degree of transparency through publicly available ledgers, trying to navigate is often challenging. Analysis tools such as YOSE can bridge the gap and identify malicious crypto wallets by, for example, cross-referencing transactions and the connections between addresses from the often vast amounts of collected data in the datasets. With advanced features such as decentralized group detection through common links and tracking money transfers across networks, investigators can identify financial crimes more reliably.

“YOSE can bridge the gap and identify malicious crypto wallets by, for example, cross-referencing transactions and the connections between addresses from the often vast amounts of collected data”

What does the future hold? A calling for solutions enabling swift and agile countermeasures

In 2019, the Association of Certified Fraud Examiners (ACFE) assessed that using artificial intelligence in fraud prevention would triple by 2022. Today, the development is exponentially growing, offering evermore opportunities for criminals and investigators. Hence, it is crucial for any actor seeking to keep up in the digitized age to adapt solutions enabling agile and swift responses to emerging threats. The vast amounts of data produced daily highlight the need for solutions with automated processing and indexing, enabling order in the chaos. Such add-ons to existing strategies will likely be crucial in risk mitigation and enhanced operation success in the accelerating information landscape.

“It is crucial for any actor seeking to keep up in the digitized age to adapt solutions enabling agile and swift responses to emerging threats.”

Furthermore, OSINT-capabilities are increasingly becoming essential as the global security situation is growing more tense with growing splits between the East and the West, illustrated by the ongoing war in Ukraine and unrest in Africa and Asia. As a result, antagonistic actors seek to influence adversarial states by utilizing proxies in terrorist and organized criminal groups below the threshold of war. A well-developed capability to track and hinder the financing of such groups through money laundering may be crucial for national security.

About Oscar

Oscar is an Intelligence Analyst & Trainer at Paliscope, focusing on asymmetric threat actors in the digital and physical environment. Apart from national security threats, he is mainly interested in the African Sahel region.